Acquisition, Products and Partnerships – October 2023

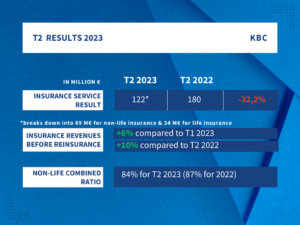

This month, KBC and Belfius Insurance announced the launch of their respective partnerships in response to the growing needs of the insurance sector. Vivium launched a new product for self-employed and medical professions. Find out more below.

- KBC and the EIF join forces for more sustainable investments

- Belfius Insurance continues to develop its healthcare technology with Senso2Me

- Vivium launches a PLCI/VAPZ in branch 23

- APRIL acquires Expat & Co

KBC and the EIF join forces for more sustainable investments

KBC has signed an agreement with the European Investment Fund (EIF) to invest €200 million in sustainable infrastructure projects across Europe for a period of at least 20 years, thereby contributing further to its sustainability policy.

KBC has signed an agreement with the European Investment Fund (EIF) to invest €200 million in sustainable infrastructure projects across Europe for a period of at least 20 years, thereby contributing further to its sustainability policy.

Belfius Insurance continues to develop its healthcare technology with Senso2Me

The insurer has chosen Antwerp-based sensor network pioneer Senso2Me for its Jane alarm system. This alliance will reduce the pressure on the healthcare sector, in particular by enabling vulnerable people to live independently in their own homes thanks to motion detectors and intelligent alarm systems.

The insurer has chosen Antwerp-based sensor network pioneer Senso2Me for its Jane alarm system. This alliance will reduce the pressure on the healthcare sector, in particular by enabling vulnerable people to live independently in their own homes thanks to motion detectors and intelligent alarm systems.

Vivium launches a PLCI/VAPZ in branch 23

Vivium, a P&V brand, is now offering a PLCI/VAPZ combining the guaranteed return of branch 21 with the advantages of a return based on investment funds (branch 23) to the self-employed and medical professionals. A standard 25% of the premium can currently be invested in branch 23.

Vivium, a P&V brand, is now offering a PLCI/VAPZ combining the guaranteed return of branch 21 with the advantages of a return based on investment funds (branch 23) to the self-employed and medical professionals. A standard 25% of the premium can currently be invested in branch 23.

APRIL acquires Expat & Co

APRIL Group acquires Expat & Co, a specialist in international health insurance in Belgium. Through this acquisition, APRIL International strengthens its presence on the European continent regarding expatriation and international mobility and enhances its portfolio of solutions and health products. Expat & Co will benefit from APRIL International’s recognised expertise in Europe and from the partnerships forged with market leaders. Expat & Co will also draw on APRIL’s technological and service base to simplify its customers’ international healthcare experience.

APRIL Group acquires Expat & Co, a specialist in international health insurance in Belgium. Through this acquisition, APRIL International strengthens its presence on the European continent regarding expatriation and international mobility and enhances its portfolio of solutions and health products. Expat & Co will benefit from APRIL International’s recognised expertise in Europe and from the partnerships forged with market leaders. Expat & Co will also draw on APRIL’s technological and service base to simplify its customers’ international healthcare experience.

Sources:

- Assuropolis, KBC Assurances soutient l’action en faveur du climat par le biais du Fonds européen d’investissement

- Belfius Insurance, Belfius Insurance scelle un partenariat avec Senso2Me, pionnier des capteurs intelligents

- Assuropolis, Vivium innove au niveau de la constitution de pension pour indépendants et professions médicales via la PLCI

- APRIL, APRIL International strengthens its presence in Europe with the acquisition of Expat & Co in Belgium