Every month, we help you keep up with the Belgian and Luxembourg insurance markets.

Mergers & acquisitions

Partnerships

Market

NatCat

Legislation

AG and BNP Paribas Fortis are Touring’s new shareholders

This acquisition concerns Touring’s operating activities. AG holds 75% of the shares and BNP 25%.

This acquisition concerns Touring’s operating activities. AG holds 75% of the shares and BNP 25%.

All operating activities keep the same brand name.

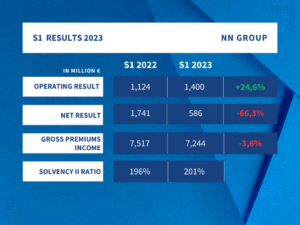

Merger between NN Non-Life Insurance S.A. and Nationale-Nederlanden Schadeverzekeringen Maatschappij N.V.

Subsequent to the merger, these insurances will be carried on without modification in Belgium by NN Non-life, the Belgian branch of Nationale-Nederlanden Schadeverzekering Maatschappij N.V.

NN Group’s strategic vision is to combine all the Dutch non-life insurers in its group into a single strong insurance company. The group also wants to preserve its strong local presence through its branch in Belgium, NN Non-Life.

Axa and Doctena join forces to strengthen access to health care

Axa will add the online calendar of Doctena to its online platform MyAXA Healthcare. Thanks to this partnership, AXA extends its range of health services and provides its policyholders with access to more than 4 600 specialists.

Axa will add the online calendar of Doctena to its online platform MyAXA Healthcare. Thanks to this partnership, AXA extends its range of health services and provides its policyholders with access to more than 4 600 specialists.

Zurich Insurance Group joins forces with Belgian insurtech Qover, to expand its embedded insurance capabilities

Zurich Insurance entered this partnership through Zurich Global Ventures. According to Qover, this partnership will “push boundaries, providing businesses and individuals even more convenient and timely protection they need in a changing world”.

Zurich Insurance entered this partnership through Zurich Global Ventures. According to Qover, this partnership will “push boundaries, providing businesses and individuals even more convenient and timely protection they need in a changing world”.

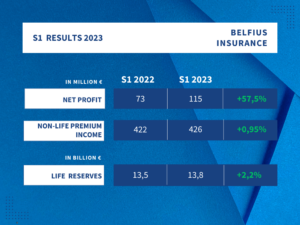

Corona Direct becomes Belfius Direct Assurances

Corona Direct gets a new name: Belfius Direct Assurances. Corona SA was fully integrated to Belfius Insurance SA and all its insurance portfolio was transferred to Belfius Insurance SA.

FSMA issues vade mecum on product oversight and governance

With this document, the FSMA sets out its recommendations and expectations regarding the supervision and governance of non-life and life insurance products on the topics of value for money and exclusions.

For more information, click here FR/NL.

Quarterly overview of Belgian public UCIs

FSMA has released its quarterly overview of Belgian public UCIs. The authority reports that the total net assets of these UCIs rose by 4.9% compared with the end of 2022, amounting to €193.5 billion. In addition, net subscriptions reached €2.2 billion.

For more information, you can access the report here.

EIOPA: quarterly risk dashboard of the EU insurance industry

EIOPA has recently published its quarterly risk assessment of the EU insurance industry. The Risk Dashboard, based on Solvency II data, summarises the main risks and vulnerabilities in the European Union’s insurance sector through a set of risk indicators.

EIOPA has recently published its quarterly risk assessment of the EU insurance industry. The Risk Dashboard, based on Solvency II data, summarises the main risks and vulnerabilities in the European Union’s insurance sector through a set of risk indicators.

The data is based on financial stability and prudential reporting collected from insurance groups and solo insurance undertakings.

You can read the full dashboard here.

EIOPA published a Staff Paper about the limited uptake of NatCat insurance in Europe

In this Staff Paper, EIOPA explores ‘demand-side’ barriers that can prevent consumers from buying NatCat insurance and proposes possible consumer-tested solutions to overcome these barriers.

In this Staff Paper, EIOPA explores ‘demand-side’ barriers that can prevent consumers from buying NatCat insurance and proposes possible consumer-tested solutions to overcome these barriers.

For more information, you can read the Staff Paper here.

NatCat law: the limit under which insurers can intervene will be multiplied by 4 to reach €1.6 billion

A recent change to the NatCat law is that, from January 2024, the limit under which insurers can intervene will be multiplied by 4 to reach €1.6 billion, driven by politicians. However, this does not solve the problem of intervention when the total bill exceeds this limit, as was the case for the floods of 2021. Finally, this change in cap will lead to an increase in fire insurance premiums for policyholders.

Future public-private partnership between insurance companies and the European Union to spread the coverage of climate risks

Amélie Breitburd, CEO of Lloyd’s Europe, recently called for a public-private partnership between insurance companies and the European Union to spread the coverage of climate risks. With the increase in climate disasters, this would help to counter the lack of protection and promote solidarity between European countries, which can sometimes be affected by this risk unexpectedly.

The AAE issues a new report on Sustainable Products on Insurance

With the release of its report on Sustainable Products on Insurance, the European organization wants to make constructive proposals and contribute to the ongoing debate of sustainibility of the insurance sector. The report states constructive proposals and contribute to the ongoing debate of sustainibility of the insurance sector. The report discusses the following topics:

With the release of its report on Sustainable Products on Insurance, the European organization wants to make constructive proposals and contribute to the ongoing debate of sustainibility of the insurance sector. The report states constructive proposals and contribute to the ongoing debate of sustainibility of the insurance sector. The report discusses the following topics:

- How the EU’s Sustainable Finance Disclosure Regulation (SFDR) aims to improve transparency about the ESG features of investment-based insurance products.

- What sustainability means for other insurance products, with a focus on insurance risks in Life, Health and Property & Casualty lines.

- How sustainable solutions can be benchmarked against the UN Sustainable Development Goals (SDGs).

- What are the key initiatives to increase transparency, through the use of a sustainable taxonomy and other non-financial reporting standards.

You can read the full report here.

Claims: insurers sanctioned for late reply

The Minister for the Economy has proposed a bill that would require insurers to respond more quickly to policyholders following a claim. If no response is received within three months, a fine of €300 will be imposed. If the policyholder has sent a reminder and has not received a response within 14 days, a fine of €300 per day of delay will appply.

The Economic Committee of the House has passed the law concerning bundled sales

In short, the conditional interest reduction is only authorised for fire insurance, debt balance insurance and surety insurance in bundled sales.

Bundled insurance policies may only be linked to the insurance company and no longer to the insurance broker.

Consumers may cancel grouped insurance policies, without losing the interest reduction, after one-third of the total term of the mortgage, and before one-third of the total term of the mortgage in the event of a rate increase (no ABEX indexation) and claim.

Sources:

- Communiqué de presse, AXA et Doctena s’unissent pour faciliter l’accès aux soins de santé

- Assuropolis, AG et BNP Paribas Fortis officiellement nouveaux actionnaires de Touring

- Press release, EIOPA research sheds light on why households and businesses are reluctant to take out NatCat insurance

- Belfius Direct Assurance, Corona Direct devient Belfius Direct Assurances

- Reinsurance News, Zurich announces partnership with insurtech Qover

- Assuropolis, Dermagne veut sanctionner les assureurs qui tardent à répondre

- Press release, Nationale-Nederlanden Schadeverekeringen Maatschappij NV and NN Non-Life Insurance NV join forces

- Communiqué de presse, La FSMA publie son vade-mecum sur le Product Oversight and Governance (POG) en assurances

- Press release, Evolution of Belgian investment funds in the first quarter of 2023

- L’Echo, Le plafond d’intervention des assureurs multiplié par 4.

- L’Echo, Amélie Breitburd (Lloyd’s Europe) : « Une couverture européenne du risque climatique aurait du sens »

- Assuralia, Ventes groupées : le projet de loi a été débattu et voté par la commission de l’économie de la Chambre

- EIOPA, Risk dashboard

- Press release, Actuarial Association of Europe publishes AAE Discussion Paper “Sustainable Products in Insurance”

Baloise is taking a further step in the sustainable development of its business by adopting a climate roadmap. Baloise has signed up to the Paris Agreement and supports the European objective of zero net emissions by 2050.

Baloise is taking a further step in the sustainable development of its business by adopting a climate roadmap. Baloise has signed up to the Paris Agreement and supports the European objective of zero net emissions by 2050.