Every month, we help you keep up with the Belgian and Luxembourg insurance markets.

Market

- Figures: travel assistance insurance

- OPC 2022 results

- Family Liability insurance comparator

- Gold medal for AG

- Insurance Ombudsman: report

- NBB: Financial Stability Report

- AG launches Go4Impact

- Results of the CBC survey about Belgians and their insurance

- Ethias launches electric car leasing business

- Assuralia calling for a legal framework for victims of natural disasters

Legislation

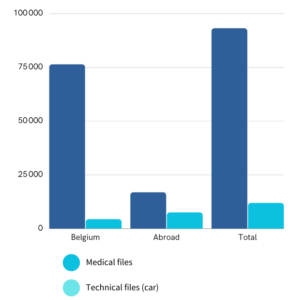

Figures: travel assistance insurance

As summer fast approaches, travel assistance insurance is on everyone’s pre-departure checklist! Assuralia has conducted a survey among its members about this insurance on the market. The results show that, last summer, more than 100,000 claims were settled and 300,000 telephone calls were made to insurers.

Breakdown of the files by location

To know more about Assuralia’s survey, click here.

OPC 2022 results

In the last quarter of 2022, the net assets of funds marketed in Belgium reached 241.9 billion euros, an increase of 2.6% compared with the previous quarter but a decrease of 12.2% compared to 2021 due to price falls in the underlying assets.

More specifically, assets in funds such as mixed funds and equity funds rose by 3.1% over the last quarter. Assets in fixed-income funds rose by 0.8%.

Here is a chart showing changes in the assets of funds marketed over the last ten years:

You can read the full article on fund assets in the Belgium market here.

Family Liability insurance comparator

The FSMA has recently launched a Family Liability insurance comparator. This comparator includes data from ten insurance companies offering this type of policy.

The data transmission procedures are regulated by a protocol between the FSMA and Assuralia.

Gold medal for AG

AG Insurance has received a gold medal for its sustainable efforts. The internationally renowned EcoVadis rating agency placed AG Insurance in the top 5% of companies worldwide in terms of sustainable and socially responsible business practices.

AG Insurance has received a gold medal for its sustainable efforts. The internationally renowned EcoVadis rating agency placed AG Insurance in the top 5% of companies worldwide in terms of sustainable and socially responsible business practices.

One of the reasons for this award is that AG has put people at the heart of its strategy by integrating diversity, equality and inclusion into its activities and by launching the AG College. The environment is also at the heart of its strategy with its 880 solar panels, its renovation project for 2027 and its 100% green company cars for 2026.

Insurance Ombudsman report

The Insurance Ombudsman recently published its annual report. The report describes trends in requests for intervention, particularly with regard to insurance companies and brokers.

With its report, the Ombudsman highlights the fact that some policyholders are no longer able to take out insurance because of the economic crisis, and that some risks cannot be covered by insurers, as most of them are unwilling to insure them.

The report also reveals that claims processing takes an abnormally long time, highlighting the need to boost the attractiveness of the insurance professions in order to increase recruitment.

In total, the number of interventions across all lines of business increased by 8% in 2022. To find out more about these interventions, you can read the report here.

NBB: Financial Stability Report

In June, the National Bank published its annual report on the financial stability of our market institutions. With this report, the regulator wishes to formulate a number of recommendations for financial institutions in an economic environment characterized by a tightening of monetary policy, a change in the credit and real estate cycles and problems that have affected the American and Swiss banking sectors in recent months.

One of the NBB’s main recommendations for the insurance sector is that the federal and regional authorities put in place a statutory framework in response to the consequences for the sector of the floods in the summer of 2021.

To find out more, you can read the report here.

AG launches Go4Impact

Go4Impact is an online tool that enables brokers to calculate in detail the carbon footprint of their activities and reduce it through actions tailored to their office. The tool is designed to meet the sustainability challenges faced by businesses and to support the 4,000 brokers in AG’s network.

Go4Impact is an online tool that enables brokers to calculate in detail the carbon footprint of their activities and reduce it through actions tailored to their office. The tool is designed to meet the sustainability challenges faced by businesses and to support the 4,000 brokers in AG’s network.

Based on a questionnaire, the tool calculates the total CO2 emissions of brokers’ activities and proposes concrete targeted actions to make their activities more sustainable.

AG provides brokers who implement these actions with a logo to promote their initiatives.

Results of the CBC survey about Belgians and their insurance

The bancassurer CBC has released the results of its “Belgians and their insurance” survey. The first observation of the CBC survey is that 85% of policyholders feel well-insured. However, 37% of policyholders do not know exactly what their insurance covers, and 56% do not regularly review their insurance contracts.

Regarding products, home insurance is the most important product for 85% of policyholders, followed by hospital insurance (75%). Life insurance attracts only 15% of Belgians.

Concerning the digitalisation of the sector, 77% of policyholders are satisfied with it, but 66% of them still want to keep a personalised contact. Furthermore, only one policyholder in 4 has ever taken out insurance online or reported a claim digitally.

Ethias launches electric car leasing business

Like other insurers (Société Générale and ALD), Ethias is starting to lease vehicles, but 100% electrically. With this business, Ethias hopes to help companies adapt to the transition to electric vehicles and the tax change that will take place from 1 July.

The offer, aimed at companies and local authorities, provides a complete package: car, home recharging point, recharging card, support, insurance and assistance. In addition, the leasing period will be 6 years, which means lower monthly payments and a more optimised Total Cost of Use. By 2027, the insurer is aiming to have a total fleet of 8,000 cars.

Assuralia calling for a legal framework for victims of natural disasters

Assuralia recently published an official statement addressing the importance of establishing a clear legal framework for compensating victims of natural disasters on the market. Together with other insurers, a constructive solution has been formulated.

The solution concerns fire insurance for homes and small businesses. It should be added that victims of natural disasters would be reimbursed by a public-private partnership, as was the case for the floods in July 2021.

According to Assuralia, this cooperation would allow insurers to reinsure the risk at an affordable price for the policyholder, without negatively impacting the company’s solvency.

On top of that, a prevention policy needs to be introduced. The government is currently in discussion with insurers on this subject.

Workers’ compensation: new political decisions

As we informed you last month, Minister Frank Vandenbroucke is seeking to impose more strict controls on refusals of compensation for work accidents.

He recently suggested that Fedris should check files rejected by insurers. If Fedris decides that the insurer’s refusal is unjustified and that the insurer does not reconsider its decision, the Ministre invites Fedris to initiate legal action.

Finally, the victim of a work accident must always be informed when his·her employer makes a work accident declaration.

Sources:

- Assuropolis, L’Ombudsman des Assurances : rapport annuel 2022

- Assuropolis, AG reçoit la médaille d’or d’EcoVadis en matière de durabilité

- Assuropolis, La FSMA lance un comparateur d’assurances RC Familiale

- Assuropolis, Chiffres du secteur des OPC 4e trimestre 2022

- Febelfin, Chiffres du secteur des OPC 4e trimestre 2022

- Assuropolis, Les assureurs ont réglé plus de 10 000 sinistres en 2022

- National Bank of Belgium, Financial Stability Report 2023

- Communiqué de presse, AG lance le premier outil de calcul d’émissions de CO2 pour les courtiers en Belgique

- Communiqué de presse, CBC – Une fois bien assurés, moins de 4 Belges sur 10 se préoccupent encore de leurs assurances

- Assuropolis, Accidents de travail : Vers une meilleure protection des victimes

- Communiqué de presse, Ethias secoue le secteur du leasing avec une offre spécialisée en gestion de flotte 100% électrique et multimarques

- Les assureurs militent pour une meilleure indemnisation des victimes après une catastrophe naturelle