This month, in addition to Baloise’s steps towards sustainability and Capgemini’s report, key figures on various areas of the market have been released. Find out more below.

- Capital investments and risks insured by Baloise will be managed according to climate criteria

- Capgemini: World Life Insurance Report 2023

- Key performance figures for the Belgian sector in 2022

- EIOPA published its Annual European Insurance Overview

- Assuralia published a report about Belgians and their insurance

- Quarterly overview of Belgian public UCIs

Capital investments and risks insured by Baloise will be managed according to climate criteria

Baloise is taking a further step in the sustainable development of its business by adopting a climate roadmap. Baloise has signed up to the Paris Agreement and supports the European objective of zero net emissions by 2050.

Baloise is taking a further step in the sustainable development of its business by adopting a climate roadmap. Baloise has signed up to the Paris Agreement and supports the European objective of zero net emissions by 2050.

The roadmap will ensure that capital investments and insured risks are managed according to climate criteria. Accordingly, Baloise intends to develop a reliable data base on which to set reduction targets for its portfolios by 2025.

Capgemini: World Life Insurance Report 2023

Life insurers should prepare for an unprecedented potential outflow of assets under management as the largest-ever intergenerational transfer of wealth nears, according to a Capgemini report covering 23 markets, including Belgium.

In response to this situation, life insurers should give priority to wealthy customers, who represent around 20% of the ageing population and who want more innovative life insurance products to help them age gracefully. This report proposes that life insurers adopt a customer-centric approach in order to offer global solutions with greater added value.

Find out more here.

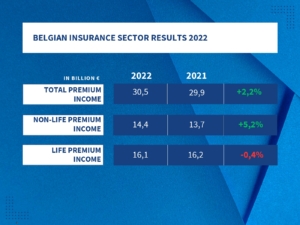

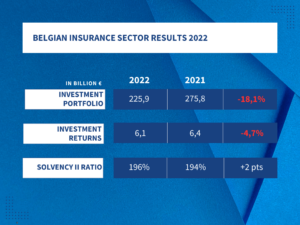

Key performance figures for the Belgian sector in 2022

Assuralia has recently released the key figures for the insurance sector in 2022.

More information: Chiffres clés en 2022 or Kerncijfers in 2022.

EIOPA published its Annual European Insurance Overview

The Annual European Insurance Overview is an extension of EIOPA’s statistical services in order to provide an easy-to-use and accessible overview of the European (re)insurance sector regarding Life and Non-Life businesses, as well as Solvency and investments.

Check out the report: European Insurance Overview report 2023

Assuralia published a report about Belgians and their insurance

The report focuses on how Belgians rate insurance. Here are a few key points:

- 44% of respondents find insurance products clear, although 49% define insurance as a complex subject.

- 18% of respondents have changed insurers in the last three years, of which 7% to save money, 5% because of a change in the household and 4% because of dissatisfaction with the claims settlement.

- Physical contact is preferred when taking out insurance, and contact by telephone is appreciated when seeking information or following up a claim.

Quarterly overview of Belgian public UCIs

FSMA has released its quarterly overview of Belgian public UCIs. The authority reports that the total net assets of these UCIs rose by 1% compared with the first quarter of 2023, amounting to €195.4 billion. In the second quarter of 2023, the sector recorded more redemptions than subscriptions, resulting in an outflow of €1.1 billion.

For more information, you can access the report here.

Sources:

- Assuralia, Chiffres clés et principaux résultats de l’assurance belge en 2022

- Press release, Baloise adopte sa feuille de route sur le climat

- EIOPA, European Insurance Overview report 2023

- Assuralia, Le Belge et ses assurances en 2023

- Assuralia, Evolution du secteur des fonds d’investissement belges au deuxième trimestre 2023

- Capgemini, World Life Insurance Report 2023