Every month, we help you keep up with the Belgian insurance market.

2. Partnership

3. Products

4. Market

6. Legislation

Mergers & acquisitions

Insudata saved from bankruptcy

After being declared bankrupt, the company Insudata, including Sigura and Cobra, has been transferred to Wim Coekelbergs, the actual director of Insudata. He will act in his own name or in the name of a company to be created.

Insudata creates and develops data management software for insurance companies.

AG and BNP to acquire Touring

AG and BNP Paribas Fortis become shareholders of Touring, with 75 and 25% respectively. The three companies are partners for several years. The amount of the acquisition has not been reported yet.

The CEO of Touring, Bruno de Thibault, believes this acquisition to be essential to remain the leader of the sector in a never-changing market. Touring will remain independent within this new organization, but will become a subsidiary of AG. As a result, Touring’s activities will be part of AG’s portfolio, unlike BNP which has no operational power.

Products will continue to be sold under the brand name Touring and this acquisition will not have any consequence for the 600 collaborators of the company.

The closing of the sale is expected by mid-2023.

Partnership

AG and Colruyt to launch an autonomous vehicle

AG and Colruyt join together to launch a project of autonomous vehicle on the public road. This vehicle is intended to deliver products from Colruyt to one of its collection point in Londerzeel. It is a great first in Belgium and it will allow AG to gain more experience in the field of mobility.

In this partnership, AG will insure the civil liability of the vehicle. This pilot project is aimed at collecting data on risks of autonomous vehicles and supporting alternative mobility.

Products

Renault and Mobilize Insurance

Renault launches a car insurance subsidiary for the European market, called Mobilize Insurance.

The objective? To market motor contracts under their own brand, associated with an insurance partnership in each country. Renault already collaborates with Allianz and Axa.

Basically, Renault will start launching its new product in France in September 2023, and then the car giant will expand it into Italy and Germany. The group’s target is 3,6 million contracts by 2030.

Market

- ING investor barometer at its lowest level

- Supplementary pension: data and bill published

- Assuralia issued new guidelines

- Regulation on variable premium insurance contracts

- Brexit: statement for insurance intermediaries

- Warning about credit insurance product offerings

- Allianz: a top-ranked company

- Axa’s decision concerning wages indexation

- Axa to pay 100 000€ to FSMA

- Some insurance premiums undervalued

- Amendments on CABRIO app

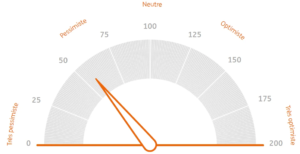

ING investor barometer at its lowest level

ING investor barometer has achieved its lowest level since 2004. In fact, the latter reached 57 points, which is 43 points below the neutrality level. Most of the investors interviewed pointed out that the economic situation worsened in the last three months.

As ING mentioned, the long-term expectations regarding the stock market achieved a low level. Therefore, investors have a smaller risk appetite. Indeed, only 21% of them think it is the right time to invest in the riskiest sectors.

Supplementary pension: data and bill published

Each year, the FSMA publishes data concerning the second pension pilar, i.e. the supplementary pension.

In Belgium, 4.170.000 people have a supplementary pension, an increase of 3% compared to last year. According to the FSMA, employees are more likely to create such fund thanks to a company plan or a sectoral plan. The reserves built up under a company plan amount to 59.3 billion euros compared to 5.4 billion euros under a sectoral plan.

More detailed information on the results published by the FSMA here.

In addition, a bill has been introduced in the House of Representatives concerning the second pension pilar. The first objective of the bill is to provide more transparent information obligations to insurance companies, as it already exists for IRPs (Institutions de Retraite Professionnelles). More qualitative and transparent information for citizens to increase trust is a second objective. Lastly, administrative simplification is intended.

The introduction of this law would be staggered.

Assuralia issued new guidelines

Concerning insurance contracts, Assuralia and the professional unions of medical experts issued guidelines for insurers and medical experts in order to ensure transparency and empathy during a patient medical expertise.

Medical experts must apply the guidelines before, during and after a medical expertise. Insurers will follow them up with medical experts of their network.

You can find more information on these guidelines here.

Regulation on variable premium insurance contracts

Mid-November, the FSMA published a regulation concerning the prohibition of variable premium insurance contracts promoted through the sale of multimedia devices.

The ban results from the fact that some sellers fail to comply with the requirements of these contracts by claiming that the premium is free in the first month, but forget to mention that the premium increases thereafter. Therefore, the authority decided to ban the sale of such contracts through a regulation approved by a royal decree.

Brexit: statement for insurance intermediaries

The Financial Services and Markets Authority published a statement on Belgian insurance brokers working with British brokers.

The statement mentions the Brexit context and its consequences for brokers. Additionally, the institution highlights the prohibition for insurance distributors to work with brokers that are not registered with the Belgian institution.

To know more about this statement, click here.

Warning about credit insurance product offerings

The EIOPA also issued a warning to insurers and bancassurers regarding credit insurance product offerings. With this warning, the European regulator would like to ensure that the products have a fair cost/benefit ratio for consumers.

To this end, measures have been taken regarding high commissions charged by insurance distributors and conflicts of interest in bancassurance business models.

You can read the full warning here.

Allianz: a top-ranked company

Allianz is a top-ranked company in Interbrand’s Best Global Brands Ranking for the fourth year in a row. The insurer ranks 34th. Its brand image is worth 18,7 billion dollars.

You can find the top 100 here.

Axa’s decision concerning wages indexation

The insurance company Axa is not going to index wages above 5 400€. This decision reflects the costs of automatic wage indexation. Els Jans, Director of Personnel at Axa, explained that the amount of 5 400€ is “the upper limit of the wage scales agreed at sectoral level.”

Similarly to other insurance companies, other bonuses, paid in units, are not indexed. In such a situation, the system of units, as well as the indexation limit, do not meet with the unions’ approval. They are therefore considering some actions. However, the insurance joint committee stated that above 5 400€, indexation is not mandatory.

Axa’s decision has a similar effect to an earthquake for the sector.

Axa to pay 100 000€ to FSMA

Failing to comply with legal obligations, Axa Belgium is due to 100 000€ to the FSMA.

At stake? Hundreds of insurance distribution acts from SPRL X through the platform of Axa Belgium between 13 April and 25 June 2019, despite the fact that SPRL X was no longer registered with the FSMA as an insurance intermediary since 9 April 2019.

Axa does not collaborate with SPRL X since 4 April 2019. Following this, producer accounts and producer mandates should have been blocked. But, due to human error, this was not the case. As a result, the FSMA considered it a fail to comply with legal obligations.

Some insurance premiums undervalued

For the Institute of Actuaries in Belgium, the conclusion is clear: some non-life insurance premiums are undervalued by 8%, due to inflation.

As a result, the pricing of specific branches of insurance will be adjusted upwards. Home insurance has already been adjusted, as it is based on the Abex index. By contrast, car insurance premiums are likely to be raised, which is already the case at Belfius Insurance.

Other players in the sector such as Ethias, Axa or AG Insurance are wondering. For some of them, an increase in insurance premiums could occur for damage and legal protection insurance.

Amendments on CABRIO app

This month, the FSMA is making a number of changes on the CABRIO application for intermediaries and lenders.

A first modification is the settlement of the automatic processing of a company change of address. Moreover, insurance and reinsurance brokers, as well as banking and investment intermediaries are not committed to mention each of their Belgian offices to the FSMA. The Crossroads Bank for Enterprises already provides them.

In addition, the FSMA has also published shorter model questionnaires for candidates and shareholders, as well as shorter model mandates. Some questions have been clarified too.

Finally, requests for simple amendments for which no documentation is required will be processed more quickly within the application.

Financial results

For the insurance group Ageas, the net income totals 567 million euros. In Belgium, the profits amount to 89 million euros.

On the life hand, Belgian receipts fell by 3% due to a decrease in volume of savings products. On the non-life hand, Belgian receipts increased by 4% thanks to the home and car insurance segments. To learn more on Ageas’ results, check this link.

Additionally, Ageas’ main shareholder Fosun, a Chinese company, stated not to trade its share. In second position of Ageas’ shareholders comes the Société Fédérale de Participations et d’Investissement (SFPI-FPIM).

Besides information on its financial results, S&P Global Ratings gave Ageas and its subsidiaries AG Insurance and Ageas Insurance Ltd. a A+ score. This score is equivalent to “a long-term issuer credit and insurer financial strength”. This definition highlights the resilience of the Group’s profits and capitalisation to the current market situation.

Concerning Allianz Benelux, the total premium income is 2,645 million euros, a decrease of 4,6% compared to last year. On the non-life hand, premiums are equivalent to 1,625 million euros and on the life hand, to 1,380 million euros.

The operating result is 284,0 million euros. More specifically, on the life hand, it amounts to 139,6 million euros, thanks to an increase in the Belgian investment margins. On the non-life hand, it amounts to 144,4 million euros, which partly results from a reinsurance transaction. More information on Allianz Benelux results here.

Similarly to Allianz and Ageas, KBC published its third quarter results. As stated by the latter, the technical income coming from the non-life insurance activities amounts to 232 million euros. The high non-life technical income is due to an increase in premiums income of 8% and a decrease of 15% in technical charge. Similarly, the earned premiums increased by 4%. The combined ratio is of 86%, compared to 89% last year. Check the press release of KBC to learn more on these results.

Legislation

- Appeal from Assuralia rejected by the Constitutional Court

- Royal decree concerning civil liability insurance for real estate agents

- Law concerning the right to be forgotten

Appeal from Assuralia rejected by the Constitutional Court

Regarding the tax on securities accounts we previously discussed, the Constitutional Court dismisses the appeal lodged by Assuralia. The latter, together with 6 other parts, previously called for the (partial) cancellation of this tax.

In this context, the Court highlights its two main objectives regarding the introduction of the tax. Firstly, the Constitutional Court wants to remove the anti-abuse provision related to the division of a security account in several ones within a same intermediate. Secondly, the Court withdraws the retroactive effect of the general anti-abuse provision regarding the period before the law came into effect.

Royal decree concerning civil liability insurance for real estate agents

The obligation of real estate agents to insure their civil liability has been revised by a royal decree which replaces the deontological directive of 14 September 2006. The decree contains a number of changes.

Basic principles do not change. However, for insurance companies, the deadline to send the list of real estate agents to the IPI, Institut Professionnel des agents immobiliers, has changed: the due date is 31 March. In addition, the IPI can now sign a collective or individual insurance contract for its members.

The royal decree came into force on 24 November 2022.

Law concerning the right to be forgotten

New changes occurred concerning the right to be forgotten that we already discussed here. Insurance companies, that are members of Assuralia, are subject to a stringent code of conduct which extends the right to be forgotten to guaranteed income insurances. However, insurers which are not members of Assuralia are not yet committed to this code of conduct. Following the government’s decision, non-affiliated insurers will now have to follow this code of conduct too.

As from 1 January 2023, the deadline for the right to be forgotten will be reduced to five years.

This law came into force on 27 November 2022.

Sources:

Assuropolis, La sur les comptes-titres: la Cour Constitutionnelle rejette le recours d’Assuralia

L’Echo, Les bénéfices d’Ageas touchés par l’inflation, mais la croissance se poursuit

L’Echo, La Chine plombe Ageas et ce n’est peut-être pas fini

Assuropolis, Ageas publie ses résultats pour les neufs premiers mois 2022

Assuropolis, le Fosun n’envisage pas de vendre sa participation dans Ageas

Assuropolis, Allianz à nouveau assureur numéro 1 dans le Best Global Brands Ranking d’Interbrand

Assuropolis, Sigura et Cobra sauvés de la faillite, la reprise est terminée

Assuropolis, Renault se lance dans l’assurance automobile en Europe

L’Argus dans l’assurance, Assurance auto : Renault repart à la conquête de nouveaux clients

Assuropolis, Allianz Benelux : résultats au cours des trois premiers trimestres 2022

Assuropolis, FSMA : règlement transactionnel de 100.000 euros avec AXA Belgium

Assuropolis, KBC: résultats de l’assurance au troisième trimestre

Assuropolis, FSMA : deuxième pilier de pension en images – aperçu 2022

Assuropolis, Modifications attendues de la loi sur les pensions complémentaires

Assuropolis, Un règlement de la FSMA interdit certains contrats d’assurance multimédia

L’Echo, Chez AXA, les salaires élevés ne seront que partiellement indexés

L’Echo, Quand Axa brise le tabou de l’indexation des salaires

L’Echo, Les primes d’assurance sont sous-estimées de 8%

Assuropolis, ING : La confiance des investisseurs belges à un niveau historiquement bas

L’Echo, AG et BNP Paribas Fortis rachètent Touring

Assuropolis, FSMA : Warning Bancassurance EIOPA

Assuropolis, Brexit : feedback statement pour les intermédiaires d’assurances

Assuropolis, S&P confirme les notations “A+” d’Ageas, avec perspectives stables

Assuropolis, Moins d’administration pour les intermédiaires et les prêteurs

Assuropolis, AG assure le premier véhicule autonome sur la voie publique en Belgique